How to Prepare Financially for a Newborn Without Losing Your Mind

By George Bailey / Dec 16, 2025

How I Nailed VAT Planning Without the Headache — A Compliance Reality Check

By Michael Brown / Dec 16, 2025

How I Synced My Car Loan with My Investment Flow

By Eric Ward / Dec 16, 2025

Why Now Is the Perfect Time to Start Building Passive Income (Even If You’re New)

By Daniel Scott / Dec 16, 2025

How I Protect My Child’s Education Fund Without Losing Sleep

By Natalie Campbell / Dec 16, 2025

How I Turned Tuition Into Investment — A Practical Playbook

By Victoria Gonzalez / Dec 16, 2025

How I Smartly Invested in Home Renovation While Riding Market Trends

By Olivia Reed / Dec 16, 2025

How I Slashed Summer Camp Costs with Smarter Tax Moves

By James Moore / Dec 16, 2025

How I Built Passive Income the Smart Way — A Real Investment Cycle Journey

By Jessica Lee / Dec 16, 2025

How I Built a Stress-Free Retirement—No Luck Needed

By Eric Ward / Dec 16, 2025

From Fractured Finances to Family Harmony: How One App Brought Us Closer

By Joshua Howard / Dec 16, 2025

How I Protect My Money Without Losing Sleep

By Christopher Harris / Dec 16, 2025

How I Tackled Debt Without Losing Sleep — A Real Risk-Smart Repayment Method

By Victoria Gonzalez / Dec 16, 2025

How I Almost Lost Everything Chasing Asset Appreciation

By Sophia Lewis / Dec 16, 2025

How I Turned Old Treasures Into Smart Investments – Advanced Antique Profit Secrets

By Jessica Lee / Dec 16, 2025

How I Blew My First Portfolio — And What It Taught Me About Fund Management

By Sophia Lewis / Dec 16, 2025

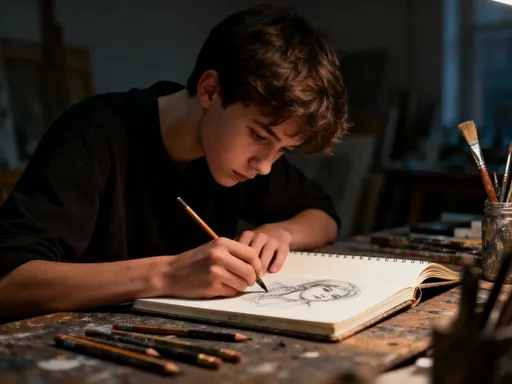

How I Slashed My Art Training Costs Without Sacrificating Quality

By Ryan Martin / Dec 16, 2025

How I Cracked the Code to Staying Free—Without Breaking Tax Rules

By Grace Cox / Dec 16, 2025

How I Turned Yoga Classes Into a Smarter Investment — Without the Risk

By Joshua Howard / Dec 16, 2025

Tired of Weekend Budget Blowouts? This App Brought Peace to Our Family

By Jessica Lee / Dec 16, 2025